Blog

Does ESG deserve to be at the top table?

25 July 2022

By Tarquin Henderson, Director, ESG Practice

My colleagues here at Echo Research have commenced fieldwork for the 33rd annual study on Britain’s Most Admired Companies. Over the past three decades, we have examined the key drivers of corporate reputation across 250 companies drawn from 28 industry sectors. We ask those leading businesses to rate their sector peers across 13 defined measures of reputation. These opinions are then complemented by those of specialist analysts and journalists. The results will be published later this year and without the necessity of turning into Mystic Meg, it’s a safe call to predict that three criteria will stand out as the principal drivers of corporate reputation across our index:

1. The Quality of Products & Services

2. Financial Soundness, and;

3. Quality of Management.

Consistently over the Study’s history, it has been these three factors which have led as the most important in adjudging how companies rank in their sector or across the study as a whole. They are what we call the ‘Table Stakes’. Quite simply, if you’re not getting these basic things right, you’re not going to have much of a reputation – no matter how good you are at other things like, dare I say, ESG.

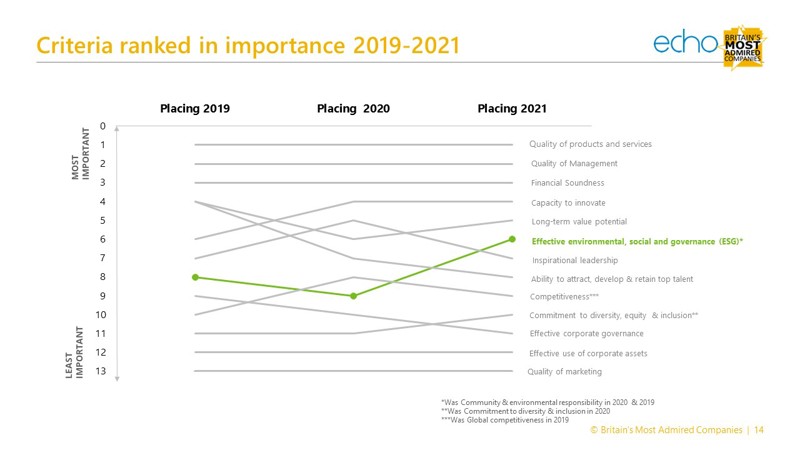

However, unsurprisingly, given the recent zeitgeist around all things Environmental, Social and Governance, ESG has been coming up fast on the rails and finished a credible 6th overall out of our 13 separate reputational drivers in 2021.

I know this fact will make the milk in the coffee of some ESG-naysayers curdle. Sorry about that. They’ll question how ESG can be more important than things like inspirational leadership, competitiveness or the effective use of corporate assets? The fact is, it just is. And what’s more, leaders of 250 of Britain’s leading businesses think so too. But I think 6th is just about right – maybe a P5 or P4 but nothing higher. We do need to keep things in perspective.

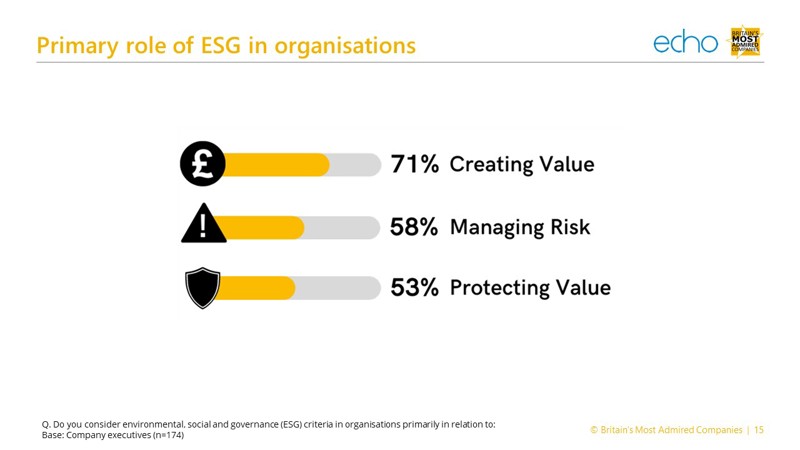

In 2021 we asked business leaders how critical ESG was to their organisation’s operations across three criteria:

That’s interesting isn’t it? Driving value. Who would have thought it? But that’s my personal experience too – quality leaders look beyond and behind the blagh blagh blagh of ESG and think strategically about how they can harness the impetus better environmental and social stewardship demands. They are seeing how ESG is not just about compliance, standardised reporting and basic posterior concealment and that it’s actually about growing their business and being better at what they do.

Back in the 80s and early 90s when I worked for a multi-national management consultancy, we’d have created a consulting brand around it - something like Total Quality, Just-in Time, Environmental and Social Business Improvement or TQJITESBI for short. But there’s no need for overblown management speak these days. We’ve just got to get on and fix things.

2022 looks a lot different to 2021 – RIP ESG?

In a recent article by Gillian Tett in the Financial Times (ESG Exposed in a world of changing priorities June 3 2022), Anne Simpson, who heads sustainable investing at Franklin Templeton suggested it was time for RIP ESG. She called for a ‘broader, human-centred approach’ for sustainable and socially progressive investing. This is in light of the very 2022 pressures being put on economies and society globally – European conflict, energy prices through the roof, rising inflation, pressures on fuel and food security. She advocates for finding the right trade-offs (ways to balance all the different goals around responsibility) in the ‘least bad way possible so as to help as many people as possible thrive on our troubled planet and prevent catastrophic climate change’.

I commend her thinking because it takes ESG away from being just….well ESG and into the real world. That’s the one we are all living in, watching buffoonish leaders mis-manage our country whilst people struggle to make ends meet, see progressive social change stall and witness our ecology degrade or simply disappear.

ESG has to become mainstream and as I said at a conference for communications professionals in Brighton back in May, the nomenclature needs to disappear, and I am sure it will do in time. So maybe Anne Simpson is right, it is time for RIP ESG.

To quote Gillian Tett from her June 3 article, ‘ the concept of ESG has moved from being a narrow area of activism - driven by people who want to change the world – to a sphere of risk management for corporate boards.’ I’d add value creation to that too given the results of our research above. Gillian Tett adds, (business risk) ‘is shaped by the knowledge that companies which ignore ESG issues can face reputational damage and the loss of customers, staff and employees’. Amen to that.

This blog has come full circle. Perhaps our 2022 edition of Britain’s Most Admired Companies will see ESG rise to the position of Table Stake. We’ll know in the late Autumn.